Citizens Insurance seeks double-digit rate increase on home insurance policies

Insurance rates have always been a major concern for homeowners, especially in the United States where natural disasters are a common occurrence. Home insurance policies can give homeowners a peace of mind knowing that they are protected against any damages to their homes that might occur as a result of natural disasters or other unforeseen events.

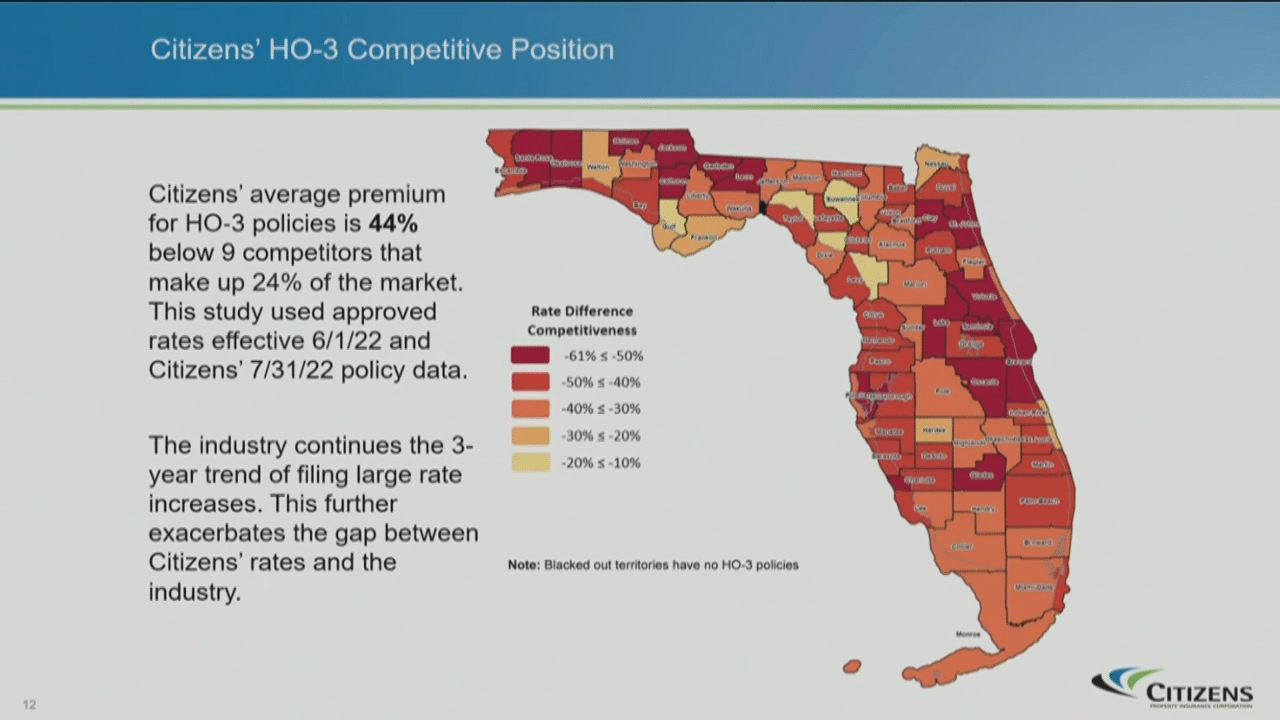

However, the cost of home insurance policies has been on the rise in recent years, leaving many homeowners feeling helpless. Citizens Insurance, Florida’s state-run insurance company, has recently sought a double-digit rate increase on home insurance policies, adding to the woes of homeowners.

Why is Citizens Insurance seeking a rate increase?

Citizens Insurance, which is owned by the state of Florida, is required to offer insurance coverage to high-risk areas where private insurance companies refuse to do so. The company insures about a quarter of a million homes in the state, making it one of the largest insurers in Florida.

Despite this, Citizens Insurance has been facing financial losses for several years, primarily due to the high number of claims that it receives every year. The company’s losses have been further exacerbated by the lack of reinsurance coverage from the private market.

In light of its financial woes, Citizens Insurance has requested a rate increase of 7.2% for its personal residential multiperil policies. The company has also sought a 9.3% increase for its homeowners’ multi-peril policy.

The impact of Citizens Insurance’s rate increase on homeowners

The proposed rate increase by Citizens Insurance is expected to have a significant impact on homeowners who rely on the company’s services. The additional cost of insurance will be a burden for many homeowners, especially those in high-risk areas who are required to pay higher premiums.

The proposed rate hike is also causing concern among public officials and consumer advocates. They fear that it could lead to a significant increase in the number of uninsured homes in the state, as homeowners may opt to cancel their policies due to the increased cost.

What can homeowners do?

With the proposed rate increase by Citizens Insurance, homeowners in Florida are left with few options. Many experts recommend that homeowners shop around for insurance policies from private companies to find a better deal. Homeowners can also consider increasing their deductibles to reduce their insurance premiums.

Another option is to look into mitigation measures that can reduce the cost of insurance premiums. These measures may include installing hurricane shutters, fortifying roofs, and upgrading home security systems to prevent theft.

The way forward: finding a balance between affordability and risk mitigation

Citizens Insurance’s request for a rate increase underscores the challenge of balancing affordability and risk mitigation when it comes to home insurance policies. Homeowners require insurance to protect their homes, but high premiums can be a financial burden, especially for those in high-risk areas.

To strike a balance, policymakers need to promote the use of technology and innovation to mitigate risks effectively. For instance, advances in weather forecasting and risk modeling can help insurance companies reduce the cost of payouts and lower insurance premiums.

Policymakers and insurance companies alike must also prioritize investments in risk mitigation measures that can help reduce insurance losses and lead to more affordable premiums for homeowners. For example, investing in flood barriers, fortifying homes against hurricanes, and investing in fire prevention measures can help reduce the number of claims and make insurance more affordable.

The conclusion: weighing affordability against risk mitigation

Citizens Insurance’s proposed rate increase highlights the challenge of balancing affordability and risk mitigation when it comes to home insurance policies. As natural disasters and other hazards continue to pose a significant threat to homeowners, finding a balance becomes even more critical.

It is important not to view the issue of insurance rates in isolation but to consider it within the broader context of risk mitigation and management. A more holistic approach that blends affordability with risk management is key to ensuring that homeowners get the protection they need at a price they can afford.