Insurance Companies Under Fire for Failed Hurricane Ian Repairs

Over the past few years, hurricanes have become an increasingly common occurrence, causing widespread damage and forcing individuals and businesses to make expensive repairs. However, many insurance companies have come under fire for failing to provide adequate coverage, leading to a string of lawsuits and legal battles. Recently, several insurance companies have been sued for failing to pay for Hurricane Ian repairs, sparking a heated debate about the responsibility of insurance companies to provide coverage for natural disasters.

Background on Hurricane Ian

Hurricane Ian was a particularly destructive storm that hit several states across the US in 2018. The storm caused widespread flooding, power outages, and property damage, leaving many homeowners and businesses struggling to recover. In the aftermath of the storm, many individuals filed insurance claims, hoping to receive compensation for the damages.

Insurance Companies Accused of Failing to Provide Adequate Coverage

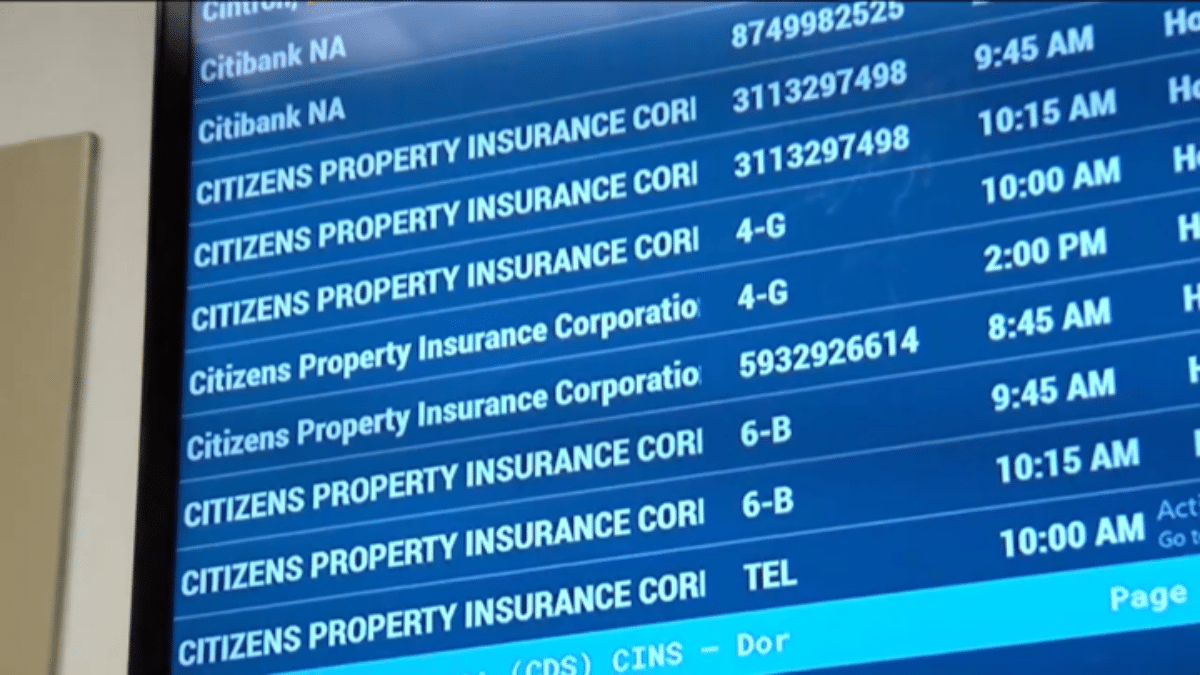

Unfortunately, many homeowners and businesses were dismayed to find that their insurance companies were denying their claims, citing technicalities or arguing that certain damages were not covered under their policies. This has led to a wave of lawsuits, with many individuals accusing insurance companies of acting in bad faith and failing to meet their obligations.

The Legal Battle Rages On

The legal battle between insurance companies and homeowners has been ongoing since Hurricane Ian made landfall. While some cases have already been resolved, many others are still pending. In some cases, homeowners have been forced to use their own savings to make repairs, while in others, individuals have been unable to make necessary repairs at all, leading to further damage and devaluation of their property.

The Role of Insurance Companies in Natural Disasters

The ongoing legal battle raises important questions about the role of insurance companies in natural disasters. While many homeowners purchase insurance policies with the expectation that they will be protected in the event of a disaster, the reality is often quite different. Insurance policies are often complex documents filled with legal jargon, making it difficult for homeowners to understand exactly what is covered. Additionally, insurance companies have been known to deny claims for a variety of reasons, leaving homeowners in a state of financial hardship.

The Importance of Reading Policy Documents Carefully

One important takeaway from the Hurricane Ian lawsuits is the importance of reading policy documents carefully. While it can be tempting to simply sign on the dotted line and assume that your insurance company will be there to back you up in the event of a disaster, the reality is often quite different. It is important to carefully read the policy documents to understand exactly what is covered and what is not. Additionally, homeowners should consider seeking legal advice if they have any questions or concerns about their coverage.

The Need for Stronger Legal Protections

Another important issue raised by the Hurricane Ian lawsuits is the need for stronger legal protections for homeowners. Many individuals have been left without recourse after their insurance claims were denied, leaving them unable to make necessary repairs and recover from the storm. This has led some activists to call for stronger legal protections for consumers, including stricter regulations on insurance companies and increased access to legal aid for those who need it.

Conclusion

The lawsuits against insurance companies for failing to pay for Hurricane Ian repairs highlight the challenges that homeowners face in the aftermath of a natural disaster. While insurance policies are intended to protect individuals from financial hardship, the reality is often quite different. Homeowners must take care to read policy documents carefully and understand exactly what is covered. Additionally, there is a need for stronger legal protections for consumers to ensure that individuals are not left struggling to recover in the aftermath of a disaster.