Some Insurance Companies Face Financial Strain as Reinsurance Deadline Hits

Insurance companies play a crucial role in the financial well-being of their clients. Their purpose is to provide financial protection to their policyholders. But in order to ensure they are able to pay out claims when they arise, insurers often purchase reinsurance. Reinsurance provides a form of insurance for insurers. It allows them to transfer a portion of the risk they assume onto another party.

However, this year’s reinsurance deadline has led some insurers to face financial strain. In this article, we will discuss how the reinsurance deadline works, why some insurers are struggling, and what this means for their policyholders.

Understanding the Reinsurance Deadline

In the insurance industry, the reinsurance deadline is a crucial date. It’s the deadline by which insurers are required to have purchased reinsurance to protect themselves against large losses. Reinsurance protects insurers by spreading the risk they take on to other companies in return for a fee.

Without reinsurance, insurers would be responsible for covering the entire cost of claims made by their policyholders. This could lead to financial instability and even bankruptcy in the event of large losses.

Typically, the reinsurance deadline falls in the summer months. This year, it has been set for July 1st.

Why Some Insurers are Struggling

While most insurance companies were able to secure reinsurance before the deadline, some have struggled to do so. This is due to a number of factors, including increasing claims payouts and higher reinsurance prices.

Climate change has also had an impact on the insurance industry. The increasing frequency and severity of natural disasters like hurricanes, floods, and wildfires have resulted in a rise in claims payouts for insurers. This has put pressure on their financial stability.

Another factor is the tightening of regulations in the insurance industry. Over the past few years, regulators have been increasing the amount of capital that insurers must hold. This has made it more difficult for some insurers to secure reinsurance.

What This Means for Policyholders

If an insurer is unable to secure reinsurance, it could lead to financial strain. This could result in the insurer being unable to pay out claims to its policyholders. This would be a nightmare situation for policyholders who depend on their insurance policies for financial protection.

Policyholders could also face the prospect of their insurer going insolvent. If this happens, policyholders would be left without insurance coverage and may not be able to recover their losses.

Moreover, it could also lead to a rise in premiums for policyholders. Insurers may increase their premiums to ensure they have enough funds to pay out claims without the need for reinsurance. This could be difficult for policyholders who may already be struggling to afford insurance premiums.

The Importance of Choosing the Right Insurer

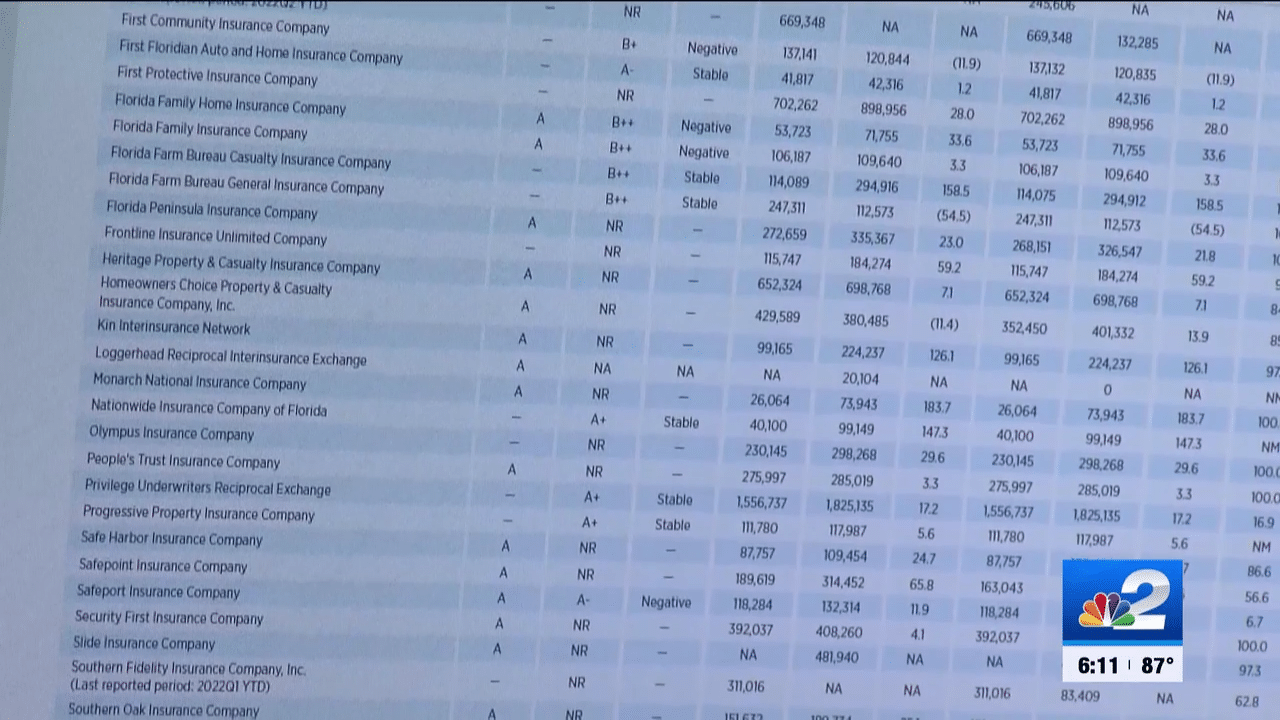

One of the best ways to ensure that policyholders are protected is to choose the right insurer. Policyholders should choose an insurer that has a strong financial rating and a good track record of paying out claims.

Prior to purchasing insurance, policyholders should research potential insurers to determine their financial stability. This can be done through online research or by consulting with an insurance broker.

If an insurer is struggling financially, it could be a red flag for policyholders. This may not be the medical condition that the policyholders are purchasing the insurance for and should be considered before making a decision.

The Bottom Line

In conclusion, the reinsurance deadline is a crucial date in the insurance industry. For insurers, it’s a time when they must ensure they have purchased sufficient reinsurance to protect themselves against large losses. For policyholders, it’s a time when they must ensure that their insurer is financially stable enough to pay out claims.

While some insurers have struggled to secure reinsurance this year, policyholders can take steps to protect themselves by choosing the right insurer.

Overall, the insurance industry plays a vital role in protecting individuals and businesses from financial loss. By understanding the importance of reinsurance and choosing the right insurer, policyholders can ensure that they are protected in the event of a loss.